Introduction

The Company was incorporated on 20 January 2017 as a private limited company. The directors present their first Annual Review on the Group, also referred to as “Zenith”, for the first accounting period of 436 days ended 31 March 2018.

On the 31 March 2017 Zeus Bidco Limited, a subsidiary of Zenith Automotive Holdings Limited, acquired the Zenith, Leasedrive, Provecta and Velo trading companies from HG Capital, these companies specialise in providing vehicle leasing to large corporate customers in the UK. On the same day it also acquired Contract Vehicles Limited, a specialist provider of heavy goods vehicle leasing and associated fleet management services. To complete the current group structure during the year ZenAuto Limited was incorporated. This company will contract all the trading activity for the newly formed personal leasing business. This creates a group with leasing capabilities across corporate and consumer sectors and from small city cars to heavy goods vehicles ranging from one day to eight years and beyond in terms of duration. Originally established in 1989 as a specialist provider of bespoke fleet solutions for mid to large corporates, our customer base includes many household brands and some of the biggest organisations in the UK. Further detail on the ownership of the Company is included in the next section.

We deliver innovative and intelligent vehicle solutions to a variety of different customers whether that’s funding company cars, light or heavy commercial vehicles, providing flexible benefit schemes, funding cars for private individuals or delivering fully outsourced fleet management services. We have a strong focus on high quality service delivery and innovation.

In order to meet our reporting requirements on gender diversity as set out in the Guidelines for Disclosure and Transparency in Private Equity we have chosen to report gender diversity in the quartiles set out in The Equality Act 2010 (Gender Pay Gap Information) Regulations 2017 rather than the categories of director, senior manager and employee set out in the Guidelines for Disclosure and Transparency in Private Equity. We have done this because we believe this improves comparability across organisations. We have also chosen not to disclose certain non-financial KPIs which we believe are commercially sensitive. In all other aspects the Directors consider the annual report and financial statements to comply with the Guidelines for Disclosure and Transparency in Private Equity.

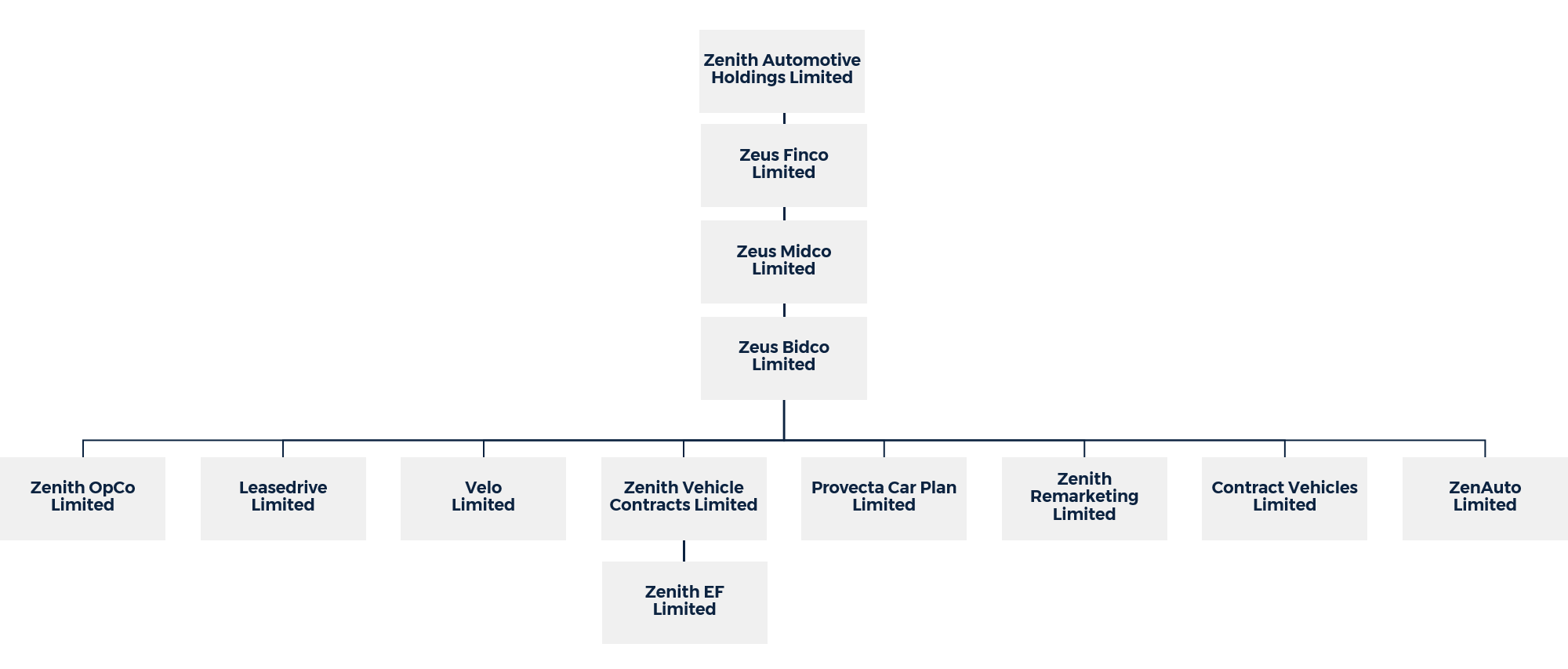

Ownership

On 31 March 2017 the Company acquired the entire share capital of Zeus Finco Limited and its subsidiary undertakings. This company structure is set out below. Each company in the structure is 100% owned. In the consolidated Group accounts Bifurcate Funding Limited and Vehicle Title Co Limited are also consolidated into the Group. These two companies form part of the legal structure under the securitisation facilities used to provide vehicle funding to the Group, but are not owned by the Group.

Zenith Automotive Holdings Limited is owned 25% by management and 75% by BEV Nominees Limited a Bridgepoint company. BEV Nominees Limited is owned by a number of limited partnerships comprising the Bridgepoint Europe V Fund.

Bridgepoint is an international fund management group focusing on private equity. Their aim is to deliver attractive returns to investors by investing responsibly in companies and building stronger, broader-based businesses with greatly enhanced long-term growth potential. As a long-established, experienced and responsible private equity investor they help companies and management teams by investing in expansion, operational transformation or via consolidating acquisitions. Bridgepoint funds invest in well-managed companies, typically taking controlling or large minority stakes. They are attracted by opportunities in sectors and niches with strong underlying growth and global competitive advantage or in cash generative businesses with high visibility of earnings.

Group structure

During the reporting period an exercise to reduce the existing group structure from 34 to 12 subsidiaries was completed. This was primarily to remove intermediate holding companies from previous private equity transactions. All trading companies and active holding companies formed at the last transaction remain within the Group.

The key rationale for this exercise was to simplify the group structure. The previous structure was overly cumbersome from an administration, statutory accounts and tax return perspectives. All companies were put into members’ voluntary liquidation following extensive work completed with our external legal team and advisors. There were no implications for suppliers or customers.

Business activity

Headquartered in Leeds, Zenith is the largest independent (not bank or manufacturer owned) vehicle leasing and fleet management company in the UK. Zenith operates a fleet of over 120,000 vehicles and focuses on:

- Serving blue chip clients with fleets of usually over 100 vehicles across business fleets, perk fleets and salary sacrifice schemes principally on a fully outsourced and sole supply basis

- Serving clients with business critical HGV and specialist vehicle fleets and

- Serving customers through the ZenAuto brand providing Personal Contract Hire vehicles

Services include provision of vehicle funding, maintenance, fleet management, accident management, short-term hire, fleet consultancy, provision of fleet data with bespoke packages tailored to corporate customer requirements.

Business model

Zenith is a Mobility as a Service “MAAS” provider. The market continues to move towards our model of providing vehicle use as a subscription service. We have capabilities across all vehicle asset types, supporting everything from business critical fleets to consumer cars.

Key elements of our business model which will deliver success in this market are:

- Zenith has over 120,000 vehicles under management and is the leading scaled multi-asset funder and manager in the UK providing mobility provision increments from 1 day to 8+ years

- Zenith have almost 30 years of experience and 700 employees. Vehicles and drivers are kept compliant and mobile 24 hours a day 7 days a week

- Zenith’s consumer brand ZenAuto, launched in the year, is a digital, direct to consumer, Personal Contract Hire solution and an exciting area of potential growth for the business

- The Group’s independent ownership enables it to be agnostic to vehicle makers, powertrains and funders

- With 38 million vehicles in the UK Zenith has significant growth opportunities in its home markets

- Through Zenith’s Alliance Partner Network, leasing capability is available in 11 European countries

Strategy

The success of our strategy is based on the delivery of the following:

- To achieve organic growth in our core markets by

- Becoming the best-in-class corporate and consumer brand renowned for being the number 1 service provider of heavy commercial vehicles, vans and cars

- Growing the fleet through the organic acquisition of new customers and cross-sell of new products to the existing portfolio, with little or no customer attrition

- Evolving the European footprint to support existing and win new corporate customers

- To enter adjacent and new markets

- Create new revenue streams by entering the consumer car leasing market and expanding white label solutions with new partners

- To use technology to drive deeper automation and service improvement

- Continuously refine the target operating model adopting process automation and digital to improve operational processing, supply chain quality, right first time delivery and improved cost to income ratios

- Continuous focus on the evolution of funding facilities

- To employ the best people

- Have the best, most flexible, agile, diverse working environment attracting the highest quality talent, nurturing our people, reducing employee churn and offering equal opportunities

- Engage our people to let them innovate, improve and grow the Company

- Develop the Zenith “MAAS” eco system

- Design and develop Zenith’s long-term mobility strategy

- Use technology to continuously refine our business proposition

- Acquisition of value accretive businesses

- Acquire companies that complement existing channels, create scale, create synergies or provide incremental income opportunities

Employees

We are committed to developing and retaining our staff, and Zenith was accredited as a Top 100 employer in the Sunday Times Best 100 Companies to Work For list 2017 in the mid-sized company category, an outstanding result. The Group has a very active employee engagement program, and we are immensely proud of this achievement. Being a business which has an obsessive focus on customer service we recognise the immense importance of developing and training our staff to the highest levels and providing them with a rewarding and challenging environment in which to work.

The Zenith Academy provides learning and development opportunities to all our people and underpins our commitment to working with our colleagues at every level to help them learn new skills and competencies that are relevant to their job and career aspirations. Zenith provide access to the Academy for all employees and have provided a broad range of training from finance, marketing, MBA, leadership and coaching courses.

Zenith is committed to developing future talent through apprenticeships. In January 2018 Zenith was named a Top 100 Apprenticeship Employer. Compiled annually by the National Apprenticeship Service, the list was announced at the National Apprenticeship Awards, which took place on 18 January 2018 at the Grosvenor House Hotel in London.

Environment and Corporate Social Responsibility (CSR)

Zenith is committed to ensuring that its business practices have positive impacts on the community and the environment. Since our formation in 1989 we have been committed to maintaining high ethical and moral standards and to ensuring that we act in accordance with responsible social behaviour.

The three core objectives of our Environmental and CSR policy are: To sustain the environment To conduct our business in an ethical and responsible manner To support the community, both local and industry sector

Environment

Operating in the vehicle leasing industry Zenith’s primary environmental objective is to provide advice and technical information to encourage our customers to promote and incorporate the most environmentally friendly vehicles and practice within their core fleet policies. This is done by a process of continuous review and assessment, constantly updating latest thinking and technology to refine and improve our customer’s CO² vehicle footprint.

This includes:

- Where clients have expressed an interest in their impact on the environment, each regular client review carried out with Zenith has contained a section on CO² emissions, alternative fuels and clean fleet management

- These review packs have been sent to customers, prospects and staff to help educate them on how the environment and company cars can work hand in hand in a positive way

- Zenith has focused on developing and training Account Managers in areas that cover the environmental issues faced by fleets and how Zenith can address them. Advice is given to fleets as well as ongoing support on developing a green fleet policy

- Zenith has piloted a scheme with a major blue chip client that ensures that all of their future pool vehicles to be supplied must be Hybrid

- A key responsibility of Zenith’s PR department is to help educate the entire fleet industry about the environment and ways of making themselves greener

Zenith as a company is proud to have achieved the CarbonNeutral® company certification by working with The CarbonNeutral® Company, a world-leading provider of carbon reduction solutions, to measure and reduce its CO² emissions. Zenith has reduced its greenhouse gas (GHG) emissions in accordance with The CarbonNeutral® Protocol, the global standard for carbon neutral certification.

The programme involved an independent assessment of the CO² emissions produced followed by an offset-inclusive emissions reduction programme. This means that for every one tonne of GHG emissions that Zenith produces, it purchases a verified carbon off set which guarantees an equivalent amount of GHG emissions is reduced from the atmosphere through a renewable energy or clean technology project.

During the year Zenith moved to new low carbon headquarters. The new 45,000 ft² offices will enhance the Company’s environmental credentials. The building is designed to a BREEAM (Building Research Establishment Environmental Assessment Method) excellent rating and is working toward a low or zero carbon rating. Solar panels are installed on the roof and an innovative energy strategy used.

Ethics

Zenith believes strongly in the need for ethics in business and to have ethical practices and transparency in all its activities and those of its suppliers. These principles strongly reflect the values of the Company and are inherent to Zenith’s commitment to ethical practices and the representation of the Company to its stakeholders and the society in which we operate.

Zenith believes we have a responsibility in the market with key issues such as:

- Treating our customers with respect and fairness and act true to our values

- To treat our partners and suppliers fairly and to establish long-term relationships that deliver value and high service levels to our end customers

- To promote within the market the need for awareness of our industry’s environmental impact with regard to carbon emissions and to work closely with specialists to ensure that we are promoting carbon reduction strategies

- Not to enter into pricing comparisons with our competitors that may lead to any form of non-competitive activity

- To work closely with government and HMRC to ensure that consistency and clarity is provided to avoid confusion and additional administrative costs for our customers

- To deliver our services through professional and trained personnel whose mandate is to exceed the clients expected level of service delivery. Our values are built around openness, integrity, service excellence, innovation and loyalty

Community

As a business Zenith is aware of its wider impact on the environment. We aim to ensure that we support our local community and integrate our business values and operations to meet the expectations of our customers and the wider public. We understand that as a business we have impacts on the communities in which we operate and employees are encouraged to assist the local community. We have established a CSR focus group to develop and promote our CSR policy.

Zenith is working with Leeds Ahead to take part in voluntary community focused projects, to assist with the social and economic regeneration of Leeds. We also encourage employees in their charitable endeavours such as supporting staff when raising funds for individual fund raising events.

We are delighted by the effort our staff put into this, and are encouraged by the feedback we receive from them in terms of the benefits they derive personally from being involved in these programmes.

Human Rights

Zenith recognises the right of every individual to liberty, freedom of association and personal safety and observes internationally recognised standards set out in the UN Universal Declaration of Human Rights and the International Labour Organisation (ILO) Conventions.

Equality

The Company has three main objectives: To encourage its employees to take an active role in combating all forms of unlawful discrimination, harassment and victimisation To deter employees from participating in any such unlawful behaviour and To demonstrate to all employees that they can rely upon the Company’s support in cases of unlawful discrimination, harassment or victimisation at work

The Company is committed to promoting equality of opportunity. This means it is the Group’s policy that there should be no discrimination, harassment or victimisation of any employee, job applicant, customer, provider of services or member of the public because of one of the following protected characteristics: age, disability, gender reassignment, marital or civil partnership status, pregnancy and maternity, race, colour, nationality, racial or ethnic origin, religion or belief, sex or sexual orientation.

Details of how we deliver these objectives is covered in more detail in our policy.

The Group is fully committed to providing so far as practicable a good and harmonious working environment that offers equal treatment and opportunities for all its employees and where every employee is treated with appropriate respect and dignity.

Business Review

The Group had no trading activity from 20 January 2017, the date of incorporation, to 31 March 2017. From the 31 March 2017 the Group includes the trading activity of the acquisitions made in the period which were discussed at the start of this Annual Review. The Group’s operating profit before amortisation of goodwill, intangibles and exceptional items is £59m for the period to 31 March 2018.

The Group balance sheet shows total assets of £1,512m including cash balances of £16m.

Despite the £59m operating profit before exceptional items and amortisation of goodwill and intangibles, the Group made a loss after tax for the period of £79m. However this was a result of deducting non-cash items of £48m for amortisation of goodwill and intangibles, and preference share and loan note interest of £49m. The Group is highly cash generative and is forecast to continue to be so for the foreseeable future.

We have a large and diversified pool of asset finance facilities available to us to finance our leasing operations which includes a significant element of committed facilities, and we have plenty of headroom with which to fund our ambitious growth plans. Our securitisation facilities provide us with extremely competitively priced capital with which to develop our business. The Group has enjoyed significant and solid support from its shareholders for its developing strategy during the financial period and the directors would like to thank them for this invaluable assistance.

The business has continued to enhance its reputation as a high quality service provider, which meets, in an innovative and imaginative way, the requirements of the market and its customers in particular. Throughout this time the Group has demonstrated excellent customer retention. The business has recently secured a number of significant contracts. The directors have considered the implications of Brexit and continue to be confident on the business’ outlook based on a strong track record of resilience in trading evidenced through previous challenging economic conditions. We are increasingly able to differentiate our service proposition helping us secure high quality new business and the directors are confident that the Group can continue this growth trend going forward.

During the year to 31 March 2018 the Group has made significant progress on the strategy detailed in this Annual Review. As well as securing a number of new business wins, we have entered the consumer car leasing market with the launch of ZenAuto and the heavy goods vehicle market through the acquisition of Contract Vehicles Limited. We have put the foundations in place to extend our securitisation funding facilities to both of these markets.

The move to our new headquarters at Kirkstall Forge in Leeds and the adoption of flexible and agile working practices is a significant step forward in our ability to attract the highest quality talent to our business and retain the best people.

The overall fleet management market is fundamentally resilient given its long term contracted nature. However, the economic uncertainty arising from the Brexit vote, as well as changes to the tax treatment of salary sacrifice schemes, have weakened the market growth during the 12 months to 31 March 2018.

Given the market environment, Zenith’s growth has slowed in comparison to past performance. However, the pipeline of new business remains strong and, once the current market headwinds are resolved, management expect growth to improve. The fundamental growth drivers of the market remain highly positive, being:

i) increasing outsourcing of the management of corporate fleets and

ii) increasing leasing, as opposed to buying, of vehicles by consumers, whether directly or via salary sacrifice schemes

In the year to 31 March 2017 the Zenith Group Holdings Limited consolidated accounts reported an operating profit before amortisation of goodwill, intangible assets and exceptional items of £54m. In the year to 31 March 2018 the Group operating profit before amortisation of goodwill, intangible assets and exceptional items was £59m.

Net debt and covenants

On 31 March 2018, the Group was funded by the following facilities:

- External bank debt of £425m. This is repayable in one instalment on 31 March 2024

- Loan Notes of £215m and Preference Shares of £272m. These are both held by the shareholders of Zenith Automotive Holdings Limited. Interest is calculated monthly and annually rolled and added onto the balance rather than being settled. These will be settled in the event of a sale of the Group or after a 20 period ending 31 March 2037

- Cash and cash equivalents of £16m

On the basis of the above the Group has net debt of £876m. Excluding balances owed to shareholders the net debt was £409m. The Group also has a Revolving Credit Facility (“RCF”) of £60m available until 28 February 2023 and a £50m Acquisition Facility secured until 29 March 2019 and repayable on 31 March 2024 if required. At 31 March 2018 no funding was drawn on either of these facilities. There is a leverage covenant which is measured once the RCF is more than 35% drawn and we must ensure that when tested the Consolidated Super Senior Secured Leverage Ratio does not exceed 1.65:1.

Capital structure

As discussed above the Group has £425m of external debt. The loan notes and preference shares total £487m and are held by the equity shareholders. The Group has a wide share ownership by employees and issued shares in the new group to employees on 29 November 2017. Annually eligible employees are invited to buy shares in the business.

This capital structure with a mix of external and shareholder debt and wide employee share ownership has been successful in supporting the growth of the business through six private equity transactions and ensuring high levels of employee engagement in the business.

Principal risks and uncertainties

The following are the principal risk areas in the business:

Key performance indicators

The directors use a series of financial and non-financial Key Performance Indicators (KPIs) to monitor the performance of the business.

Tax

At Zenith we are proud of our service and ethics. Honesty is one of our core values and we apply this to our tax affairs and our dealings with tax authorities and tax advisors in the same way we apply it to all our business activities.

We will fulfil our commitment to paying the right amount of tax that we owe by seeking to pay the appropriate tax, at the right rate and at the right time. We aim to do this by ensuring that we report our tax affairs in ways that reflect the economic reality of the transactions we actually undertake in the course of our trade.

We are committed to paying all the taxes that we owe in accordance with the tax laws that apply to our operations. We believe that paying our taxes in this way is the clearest indication we can give of our being responsible participants in society.

Dealing with HMRC

We have built long term relationships with our tax advisors and discuss with them new products and services to ensure the correct tax treatment is adopted. We respond to requests from HMRC in a friendly, timely and professional manner. Where the tax treatment or reporting requirements of specific items are unclear we always seek professional advice. The Senior Accounting Officer and Chief Financial Officer are involved in all these discussions.

Our advisors also keep us updated on tax law as it evolves.

In the event of an enquiry we would be committed to co-operating fully with any investigation with a review to timely resolution of issues. Further details of our tax policy can be found here.

Going concern

The Company makes use of bank facilities agreed on a Zenith Automotive Holdings Limited Group wide basis. On 31 March 2017 the Group secured new bank loan facilities and settled its existing bank loan facilities. Following the refinancing, the Group has considerable financial resources to manage its operations (see net debt and covenants above). The directors note that the Group is cash generative and have reviewed the forecasts which cover a period exceeding 12 months from the date of signature of the financial statements. On this basis, the directors have a reasonable expectation that the Group and the Company has adequate resources to continue in operational existence for the foreseeable future. Thus they continue to adopt the going concern basis in preparing the annual financial statements.

Future developments

Of the 38 million vehicles in the UK today, Zenith’s strategy to enter adjacent heavy commercial vehicle and consumer markets now puts the Group in a strong position to grow the business from city cars to heavy commercial vehicles across corporate and consumer markets. In our opinion Zenith is the leading UK proposition with management, technology and funding capabilities in every market segment.

Our corporate vision is to be the benchmark by which quality service is measured within our industry. We are accelerating the pace of investment in systems, infrastructure and people, having recently approved multi million pound investment programmes in these areas which will enable us to continue improving our service levels to customers and keep us at the vanguard of innovative service delivery.

The business has a robust base from which to continue to build and we have many exciting opportunities with both new and existing customers which we expect to be able to develop in order to further drive the creation of shareholder value.

Over the next year Zenith will focus on developing the brand, systems and market for the consumer product and integrate fully the heavy commercial vehicle operations into the business to enhance the corporate offering.

M T Phillips

Chief Financial Officer

27 July 2018

For further information, view the Zenith Automotive Holdings Limited accounts on Companies House, or click here.